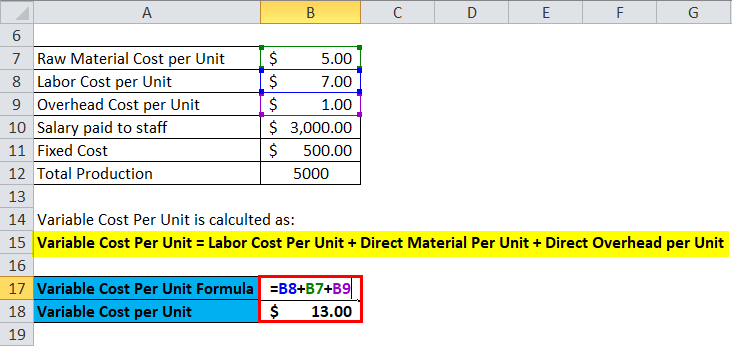

To work out the per-unit contribution margin, management could either use the formula above and use the sales price per unit and variable cost-per-unit, or they could divide the $1,000,000 contribution margin by the number of units sold. Assuming fixed costs are $500,000, this would leave the company with $500,000 in profit at the end of the year. Ironbridge has $1,000,000 left to clear its fixed costs after paying its variable costs of $1,000,000. Let’s calculate the gross contribution margin for Ironbridge: The following are the company variable costs: Ironbridge Containers registered sales worth $2,000,000 in the last financial year that ended in July 2018. It doesn’t matter how many products they produce, the rent will cost the same. It’s not common to issue income statements that split variable and fixed costs, but some companies do separate them.Īn example of a fixed cost would be rent paid for a company’s warehouse. Variable costs are not typically shown on company financial statements and the usual way to get the figures is to tally them up from the income statement. The more the business produces the more it will spend on raw materials and labour, and that is the reason why this cost varies with an increase in production. Variable costs are costs that change in a company with an increase in production.Įxamples of variable costs include the cost of raw materials, cost of labour, shipping etc. The second element of the contribution margin formula is the variable costs. The net sales figure will be reported on the company income statement either as net sales specifically or as the only sales figure. The sales revenue is net sales – total sales less any returns, discounts, or allowances. For this, you would use the same formula, but input the values for one unit:

Management may also want to calculate the contribution margin on a per-unit basis. You can also express the contribution margin as a percentage by using the following formula: Contribution Margin FormulaĬalculating the contribution margin of a company is a simple process, as all you need to do is subtract the total variable costs from the net sales revenue figure of a business. When you subtract that variable cost of delivering a product from the sales price of the product, the remainder is the contribution margin.Ĭontribution margin is more of a managerial ratio because it allows management to determine how effectively they can combine all the factors of production to produce a given product spending the least amount of money in the process.Ĭontribution margin can be stated as either a gross or per-unit amount and it’s used to measure how much a specific product contributes to the overall profit of the company. Put simply, when a business manufactures a product or offers a given service, there is a cost attached to it. The contribution margin measures the difference between the sales price of a product and the variable costs per unit.

0 kommentar(er)

0 kommentar(er)